Price Elasticity in B2B: The Real Meaning of Optimization

By Zilliant

Aug 05, 2020

Many companies are making the push toward using data and tools to make betterdecisions and improve performance. While that’s certainly better than relying on gutinstinct or guesswork, “better” is not the same as best, oroptimal. After all, your job is tomaximizepricing performance, not just slightly improve it. There’s no need to crawl, walk,then run. Juststart running. In other words:make optimal decisions, not just better, data-driven ones.

The Definition of Optimization

The term “optimization” is widely used in the pricing field to describe applications that setprices. With so much use, the definition of what optimal truly means has become nearly asconvoluted and murky as the term “Big Data.”

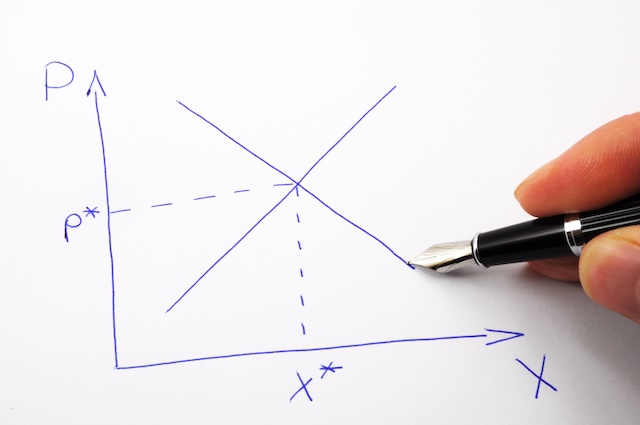

Below is the actual definition of optimization, rooted in math and science.

Optimization Model: A mathematical system that prescribes decisions and predicts

outcomes against specific objective(s), for example, maximize profit dollars, subject to

constraints of the real system. In business terms, this means that they are simultaneously

balancing trade-offs (e.g., price vs. win rate) and accommodating for constraints to find the

best answer. The quality of the guidance produced is largely a function of the reliability of

the parameters (in the case of pricing, elasticity) used in the model and the model's fit, or

similarity, to the real-world business environment.

More simply stated:

Optimization is a decision-making process that employs data, algorithms and software to

make recommendations faster and better than humans. By examining all possible choices,

it predicts the outcome of each, andselects the one which maximizes business results.

When applied to pricing, it examines all possible price choices, predicts the revenue and

profit outcome of each and selects the one that maximizes business objectives.

Optimal Provides Greater Value than Improved Efficiency

Price optimizationis not about just using automation tools to make decisions faster or just usingdata to make better decisions.

For example: A large distributor goes through the painful process of preparing a price listtwice a year using 15 people, which takes 10 weeks. Following the implementation of newpricing execution tools that help automate this process, it now takes five people six weeks tocomplete the same task, which is an improvement as the distributor reduced the required manpower. But it’s still not optimal. Costs, competitive dynamics and customer demand change more frequently than twice a year, so only adjusting prices twice a yearwon’tkeeppacewith the complex factors that should be accounted for when setting prices. Perhaps more importantly, the price list fails to account for the expected margin, the revenue outcome and the sales representatives’ tendency to discount from the list price because of various selling circumstances.The distributor needs dynamic pricing software in order to fuel a real-time omnichannel pricing strategy.

Price Elasticity Measurement is Central to Optimization

The purpose ofpriceoptimization is to find the set of inputs that lead to the maximum output. In other words, find the prices that result in the best revenue or margin outcomes for each part of your business. The goal is not just to have different prices, it’s to hit certain revenue and margin targets, using price.

In order to predict the revenue and margin outcome, you have to know how different customers will react to price changes across various circumstances, which requires knowledge of price elasticity. Price elasticity is the single most-important factor in setting profitable prices while keeping revenue risk to a minimum. If you don’t understand price elasticity for a given customer segment, you risk leaving money on the table or losing profitable sales.

Most B2B companies do not use price elasticity to set prices because they assumethey can’t. Instead, these companies rely on backward-looking analytics or statistical distributions of prices. It’s been a long-held belief that price elasticity is impossible to calculate in a B2B selling environment. That’s simply not true. It is possible to measure how market segments respond to price changes and thus optimize outcomes.

The data needed to take a scientific approach to price optimization already exists. It’s readily available transaction data — the customer, product and order data that every company captures in the course of doing business. From that data, you can segment customers into small groups that have similar price response and measure the price elasticity on an ongoing basis for each segment.

Taking a surgical approach to pricing, or actually OPTIMIZING prices, by measuring price elasticity, can have a dramatic impact on profitability while minimizing risk and improving responsiveness to market dynamics.

Rules Don’t Address the Root Cause

Most of the “better” solutions, particularly approval automation and rules-driven solutions,treat symptoms rather than the root cause. For example: A manufacturer has stale prices in its price matrix, resulting in 5,000 exception price requests (spot-bids) per month. The pricing department is overwhelmed with these requests, causing huge friction betweensales and pricing. Many companies seek out a solution to speed up these price requests and some seek out rules-driven solutions in an attempt to automate the discount approval process. These options only help get to the wrong prices faster because both fail to address the root cause that matrix prices need to be market-aligned. Rulesalone don’t generate optimized prices.

By just correcting the price guidance given in the matrix, companies have seen exception requests drop by 50 to 60 percent, while improving overall margins! Sothey not only get better results, but they also spend less time managing overrides and exceptions.

Optimization solutions do use rules. However, it’s how those rules are applied that is important. Traditional rule-based pricing solutions apply rules sequentially, which means they can’t resolve any conflicts while determining the best price. Sequential rules often lead to multiple “correct” but contradictory answers, depending on the order in which the rules are applied. On the other hand, optimization solutions process rules simultaneously, which means that the model takes all of the constraining factors into account and gives the truly optimal, or best, answer.

No Such Thing as One-Size-Fits-All Pricing

Don’t confuse an optimized price recommendation with a simple price build-up calculation. For example: You embark on a data-driven analytics study with a team of consultants, and they recommended that product line A sell at a 20 percent margin, line B at a 25 percent margin, etc. You code that data-driven recommendation as a new pricing rule which calculates the 20/25percent mark-up over cost. How sure are you that these rules will give you the outcome that you are seeking? You aren’t, and they won’t. Differentiating on sensitivity is harder than simple rules, but it’s the only way to stay market-aligned and maximize results.

Look at it from a different lens: You likely have different expectations and goals for different customer segments. You may want to take market share in Asia, maximize margins in Europe, or be more price-aggressive with small customers in the U.S. to account for higher costs to serve, all at the same time. So, shouldn’t your price strategy vary to accommodate those different goals rather thanapplyingone monolithic mark-up over cost rule?

Why Hindsight Analytics Fail

For years, weather forecasters have used climatology to make predictions by looking backwards at long term averages. But, just knowing that the average high temperature on this date doesn’t mean today’s high will be the same. “Past averages” can’t accurately predict what will happen today or tomorrow, they only describe what happened before.

Today, forecasters rely on sophisticated mathematical models that take numerous factors into account to predict the weather. Today’s weather models aren’t always right, but the forecasts they produce are a drastic improvement over average-based methods.

We accept this as best practice in weather forecasting, but when it comes to making business decisions, we often still rely on the business-equivalent of the Almanac — reports or past averages. These hindsight analytics don’t suggest what is likely to happen in the future, or more importantly, what you should do today to get the outcome you want tomorrow.

In pricing, reports and hindsight analytics often show where pricing mistakes were made. They don’t tell you how to set prices and negotiate going forward, and more importantly how customers will respond to those prices. Will you continue to leave money on the table? Or, will you lose the sale as a result of being too aggressive?

To effectively set prices, or forecast price response in the market, you need a predictive model — not an almanac of average price results.

Contact usto go OPTIMAL today!