Why the Eventual End of Tariffs Isn't the End of the Threat (And What You Can Do)

By Brooks Hamilton

Feb 11, 2020

With the January 15 signing of a “Phase 1” trade deal with China, the U.S. tariff actions may be inching closer to a resolution.

For many U.S. manufacturers and distributors, the prospect of tariffs in the rear-view mirror should be a call for celebration, right? Not so fast…

The transition period, whenever it arrives, is fraught with obstacles. An end to the tariff program (whether quick and precipitous or more drawn out) presents a massive pricing problem. During the tariff period, most distributors have added a tariff line item to their quotes to pass costs on to customers. This brings transparency and is palatable, as customers expect some level of raised prices during this time. Most manufacturers have been forced to fold the extra cost into their product price, again finding their customer base both reluctant and sympathetic.

But consider the unique cost and price circumstances when the tariff program finally ends. Will any customer want to pay for tariffs that no longer exist? How will customers respond to prices heavily influenced by tariff-laden, high cost inventory? What do your competitors’ tariff-influenced inventory positions look like? The risk for substantial margin erosion and/or volume loss caused by this zombified inventory is real.

Imagine you’re a distributor that operates with thin net margins (<5 percent) and you currently hold inventory dominated by items that carry 25 percent higher costs due to tariffs. If tariffs go away tomorrow, the nightmare scenario is easy to envision. Your customers are unwilling to pay for tariffs on a program that no longer exists. You must do everything you can to avoid being caught holding the bag when tariffs are repealed. This will involve walking and chewing gum at the same time. Meaning, you must prepare for the end of tariffs without kneecapping your ability to hit margin and revenue goals in the interim.

The companies quickest to act in the most innovative ways will be the ones who come out ahead of all this. With that in mind, let’s discuss some of the major decisions looming, how to prepare for the end of tariffs and how to manage your pricing in a post-tariff world.

Major Determinations

In order to act quickly and meaningfully, you will have to collaborate on a game plan with other parts of the business. Connect with Procurement/Supply Chain to get a sense of the tariff-affected inventory you already hold and buying plans going forward. Align with the executive team and sales management on a post-tariff pricing strategy. These conversations will be crucial to understanding the scope of your problem, the right timing of price changes and the prices your customers are likely to accept before and after the tariff actions go away.

With the team on the same page, sharpen your pencil and attempt to decide on unified answers to questions like:

How do we change our prices when tariff programs end in order to offset or recoup already-made tariff payments? How have we passed along the cost of tariffs to date (as a line item or within our product price)? What has the competition been doing? Should we spread out price increases in smaller increments over a year or a large pricing action? How should the pricing action be communicated to the market, if at all? Should we take a hit to the bottom line by discounting prices on tariff-affected inventory? Where are we in the supply chain (i.e. how much of the “upstream” supply chain might be loaded with tariff costs)? Do we know which customers are price-sensitive? Do we know which products are sensitive? Can we even begin to manage the price increases with so many unique segments? How do we manage pricing campaigns when they aren’t directly tied to product costs?

This last point is a particularly sticky one for most B2B companies, who have either defaulted to cost-plus pricing over the years or rely on manual processes to arrive at a price. Neither option constitutes a successful pricing strategy in steady times, let alone when navigating modern tariff flux.

Preparing for Post-Tariff Business (Playing Defense)

If you’re like most B2B companies, you might come out of these strategy meetings with less-than-satisfying answers and likely more questions. But in aligning your departments on a plan, you’re doing more than most. Looking to the future, we understand that tariffs won’t go on forever and you need to be putting together your strategy now.

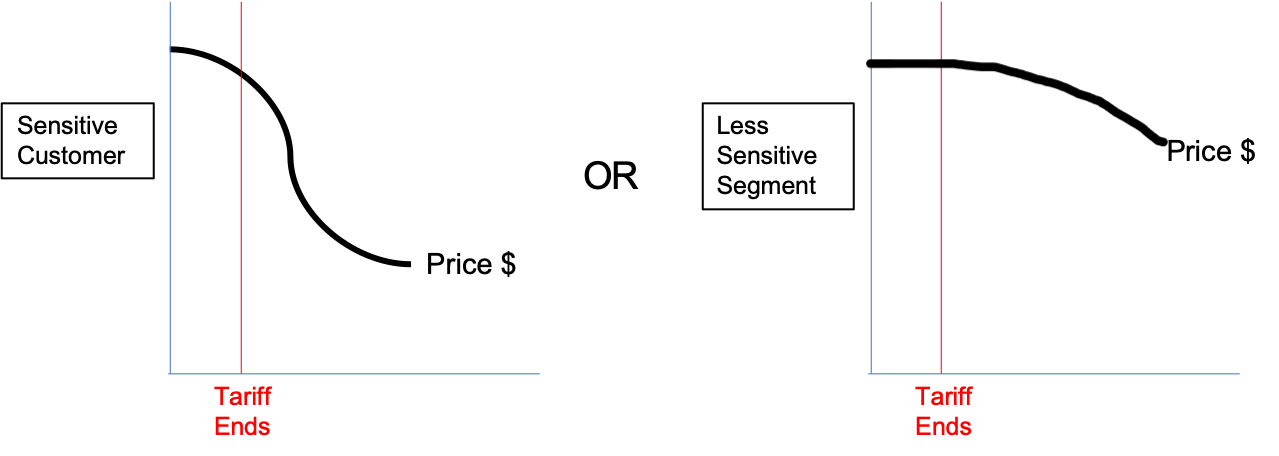

The right strategy will include implementing surgical price changes while reducing your cost basis. As covered in our Talking Tariffs series, more intentional cost pass-through driven by data science is something every tariff-impacted B2B should be doing today. The ability to identify segments with low price sensitivity where prices can be raised is invaluable. Raising prices preemptively, in accordance with price elasticity, can help make up for anticipated post-tariff margin loss.

On the cost side, work with your procurement team early. An analysis on your own buying patterns will help determine the need for preparatory tactics like:

Making smaller and more frequent purchases to maximize flexibility. Avoiding locked-in quantities / deliveries. Arranging for larger purchases to occur after the tariff program ends, rather than before. Sourcing from non-tariff-impacted suppliers while tariff programs are winding down, even at a higher base product price.It will clearly take more than the pricing team to determine feasibility and to execute on your strategy. Coordinate with internal partners on immediate changes and ensure everyone across the organization is ready to put post-tariff plans into effect abruptly when the time comes.

Managing a Tariff-Free Market (Playing Offense)

Fast-forward to the day of the formal announcement stating that the long tariff saga is over. If you’ve done your prep work, you can respond to new market conditions before the ink is dry. This is where you have the opportunity to stop playing prevent defense and start putting points on the board.

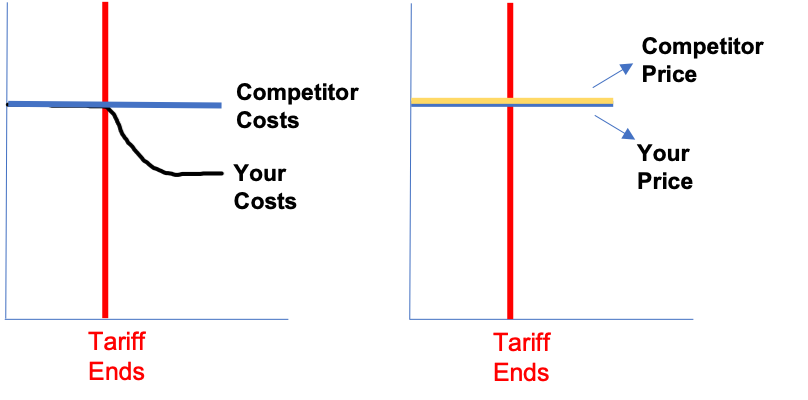

Thanks to your preparation, you may find that you are well-positioned compared to your competitors to take advantage of the situation. You’ve proactively minimized your cost-inflated inventory and captured additional margin where achievable, while others in your industry are now in panic mode. As the saying goes, “Never let a good crisis go to waste.”

If your competitors emerge post-tariffs with inflated costs, you can likely keep your prices higher even though your cost basis has decreased. There’s less of a chance of getting beaten on price, so it’s time to rake in the margin.

After years of inflated costs, the market may take some time to psychologically “reset” when tariffs go away. This presents another opportunity to scoop up big margins by keeping prices higher for a time and gradually gliding them back down. Don’t do this blindly, however. Price elasticity is still your North Star.

Final Thought

Tariffs will come to an end. The only questions are when, and how ready will you be? When the inevitable happens, there’s no excuse to be caught by surprise. Instead, organize your internal teams, collectively determine your risk exposure and put the right pricing tools in place to formulate a winning strategy now.