What is Rebate Management?

By Zilliant

Aug 16, 2022

Table of Contents

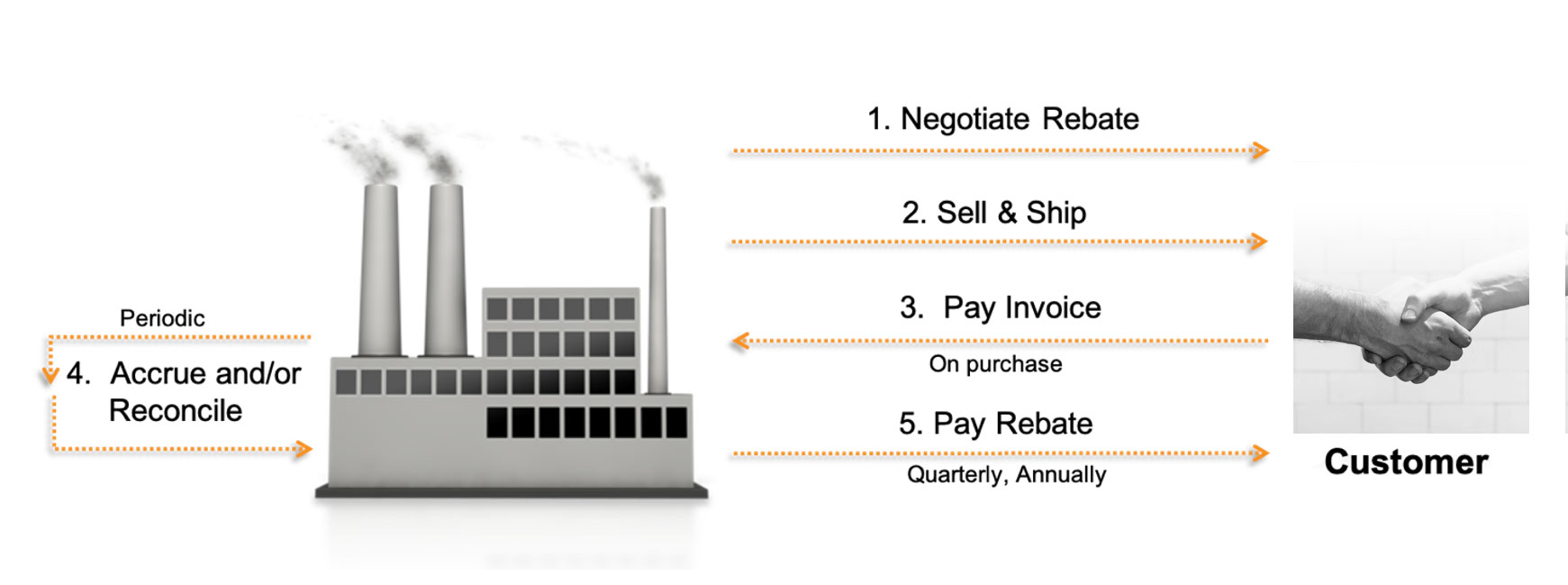

Customer rebate management is the process of creating rebate and other off-invoice incentive programs, enrolling customers in those programs, accruing payments, forecasting profitability, and analyzing program effectiveness.

Most B2B companies manage this complicated, time-consuming and multi-departmental process manually, using spreadsheets and legacy systems. This creates challenges because rebate management can only be effective if sales against rebate agreements are tracked precisely, and rebate claims are paid out in a timely fashion.

Why is Rebate Management Software Necessary?

Manual processes are error-prone, inefficient, and ultimately counterproductive. Accordingly, an increasing number of B2B companies are adopting a centralized rebate management system built on a flexible software platform.

First, let's discuss the value of rebates and define common off-invoice incentive programs. Then, we'll talk about how a rebate management solution benefits stakeholders across an organization and its customers.

Whitepaper: What is Rebate Management?

Off-Invoice Incentives, Defined

Rebate and other off-invoice incentive programs are highly strategic and potentially invaluable to B2B companies of any size. These programs drive brand loyalty, incentivize the desired customer behavior and protect price integrity by preventing over-discounting. Common incentive programs include:

Rebates

The most common form of off-invoice discount, a rebate is an amount paid from a supplier to a customer after the latter has met an agreed-upon metric or criteria. Rebates can be based on volume programs, sales targets, incremental growth or targeted accounts and products.

Promotions

Off-invoice promotions include vehicles such as coupons and temporary or time-boxed discounts, often based on a stated volume.

Shared Expenses

From time to time, companies will partner on joint advertising and business development initiatives, with off-invoice payments changing hands at a later date based on the success of the program.

Rebates and other off-invoice incentives factor in significantly to both pocket price and pocket margin. Since these payments are made well after the initial agreement, they can negatively impact margins if not carefully accounted for, as we will explain below.

For the purposes of this article, we will refer to each of these incentive programs as “rebates” from here on for simplicity.

Why Managing Rebates is a Challenge

The process of rebate incentive management is cumbersome and only grows in complexity the larger a company is, and the more rebate programs it offers. It’s not uncommon for a company to offer a wide variety of rebate deal structures to its clients, sometimes without a clear understanding of who is doing what internally.

For instance, a sales manager may create a one-off rebate program for several strategic accounts in his or her territory. Finance is ready to close the books in January, but then it becomes aware of this deal and has to do last-minute scrambling to account for it, issue credits, and recalculate company financial performance. Little thought to corporate strategy or the health of the business was considered in this one-off scenario, which is all too common.

The above example is indicative of a decentralized, manual rebate management approach. Given the time lapse between rebate agreement and actual payment, plus the multitude of departments involved in the process, the traditional tracking methods are insufficient. All the benefits of a rebate program, such as customer loyalty and increased sales, become short-lived. Instead, payment disputes or delays torpedo the customer experience, while internal confusion and tedious hours spent deciphering spreadsheets frustrate employees.

Slow and delayed payments or disputes over what was initially agreed upon tend to be the headlines when discussing poor rebate management. Indeed, these problems lead to highly visible customer satisfaction issues and a slower cash flow.

Of equal importance, however, is the rigor that must go into setting up the thresholds and parameters that make up each rebate play. How much intelligence goes into setting volume and growth targets, or for that matter, payout amounts? How reliable and accessible are performance metrics? For most B2B companies, the answers to those questions are “not much” and “not very.”

An automated rebate management system can help resolve issues like these, by facilitating collaboration between trading partners, providing greater visibility and control over financial performance, and ultimately strengthening customer relationships.

Who is Involved in the Rebate Process?

As alluded to above, a complicating factor inherent in rebate management is the multi-stakeholder nature of the beast. The following personas play crucial roles in the process and must work collaboratively to succeed.

Product Management

Often, product managers serve as rebate managers for product-specific campaigns. It is up to them to identify and quantify the target products and sales goals, respectively.

Pricing

Pricing managers must be intimately involved in defining payment tiers and calculating rebate thresholds. They need to be anticipatory and project various outcomes, ensuring that deals meet profit goals whether rebates are achieved or not.

Sales

Sales reps are expected to be aware of which rebate programs their customers are eligible for and ensure customers are enrolled and aware of the thresholds they need to meet. Sales operations teams must alert reps when customers are approaching a threshold, arming those in the field with specific guidance (i.e. “You have 2 months to spend another $50K in order to receive a 2% rebate payment”).

Finance/Accounting

Finance and accounting groups are often the last link in the chain, but perhaps the most important. The accounting team is ultimately responsible for accruals, payment and final reconciliation. Finance needs an easy way to tell who has been paid, who needs to be paid and when payment is expected. An effective rebate management system includes analytics that convey profitability reports and spotlight problem areas that need to be addressed.

What is the Ideal Rebate Management System?

As we’ve highlighted, the myriad teams and agreements at play in a typical rebate management process can create overwhelming complexity. The sheer amount of manual work and potential accounting discrepancies tend to make rebate programs another cost center in the business, nullifying the desired benefits. The flexibility and interoperability of modern rebate management software is required to realize the full value of a rebate strategy.

The ideal rebate management system removes superfluous manual work and allows users to seamlessly accomplish the following tasks:

1. Rebate Agreement Management

Enable a top-down approach that defines all aspects of a rebate program: the products and services included, eligibility requirements, program terms and conditions, sales thresholds, and payment tiers. Once set up, the system acts as the source of truth for rebate agreements that all stakeholders can refer back to and receive marching orders from.

2. Customer Profitability Analysis

As rebate programs are defined, the ideal system includes both forward- and backward-looking analytics. Users can simulate the impact that proposed rebates will have prior to pushing them live. Once the program is in market, a detailed analysis can be run on pocket price and pocket margin performance.

3. Rebate Accrual

Accurate accruals are critically important to any rebate program. Companies need software that can track in real-time, without manual input, the status of customer performance against rebates and know which are due for payments.

4. Notify Account Managers of Rebate Opportunities

Once rebate agreements are created, rebate management software ensures sales reps are made aware of which programs their customers are eligible for. Then, after they have enrolled, the system can alert them when customers are approaching a rebate target. This ensures the program is effective in driving the behavior and, ultimately, revenue growth a company is aiming toward.

5. Calculate and Issue Credits

A system of record that acts as the arbiter of final rebate amounts and can settle any disputes or overrides quickly and to the satisfaction of both parties is critical. The system will then be able to issue owed credits to customers.

6. Measure Program Effectiveness

After rebates are paid out and the books are closed, the system must be able to analyze revenue and profit impact across customer accounts, products, geographies and more. This is critical to determine how programs can be improved moving forward.

Internal and External Benefit

Rebate management software is proven to enhance the experience of both the internal stakeholders and participating customers, while better accomplishing stated financial goals.

Product and pricing managers operate from a common console to make decisions that incentivize the right behavior from sellers and customers. The ability to scope and filter rebate criteria, and set thresholds and payment increments, allows teams to get to a level of granularity that spreadsheets cannot. The in-line analytics replace the guessing game – now rebate managers know how programs are performing, which completed programs need to be improved, where to set payment caps, when to get more or less aggressive, and much more.

Sales reps can instantly discover which rebates their customers are eligible for and easily enroll them. A rebate money map gives a quick glance of performance to date by program and by tier, informing the next best course of action and which customers to reach out to.

Finance finally gains a 360-degree view of active rebates and accruals, with a simple dashboard showing who has been paid and when the next payments will come due. Profitability analysis is made easy with price waterfalls giving a complete picture of impact to the bottom line, especially when the rebate management software is fully integrated with price management software. The finance team is empowered to make better future decisions based on real-time performance data.

The best rebate management software is also a major customer satisfaction driver. We’ve covered how poor rebate management frustrates customers with long payout delays and disputes over agreement terms. An intelligent system eliminates the inadequacies that lead to miscommunication, confusion and wasted time. With the right tools, companies can turn their customers into true partners in the rebate process, as they should be.

“Customers are dealing with a number of suppliers and all of them have different rebate programs, and the formulas and thresholds are different. So it’s kind of a weak expectation that the customer is situationally aware of when they’re about to trigger a breakthrough amount of rebate dollars for themselves,” said Zilliant General Manager of Commercial Excellence Barrett Thompson, on a recent podcast episode. “It’s a win-win if the sellers inside a manufacturer or distributor are alerted to tell their customers, ‘Hey, you’re close to a rebate. Just pick up a little more volume here and you’re going to unlock a credit.’ Customers are going to welcome that phone call.”

Learn More: B2B Reimagined, Episode #36

Conclusion

While rebates are a highly strategic lever for any B2B business to pull to grow sales and increase brand loyalty, the status quo of manual rebate management often negates these benefits. With cloud-native software, the rebate management process becomes a top-down, centralized, data-driven and financially rewarding one.