Is eCommerce a Threat or an Opportunity? Innovative Distributors Have the Answer

By Zilliant

Sep 11, 2019

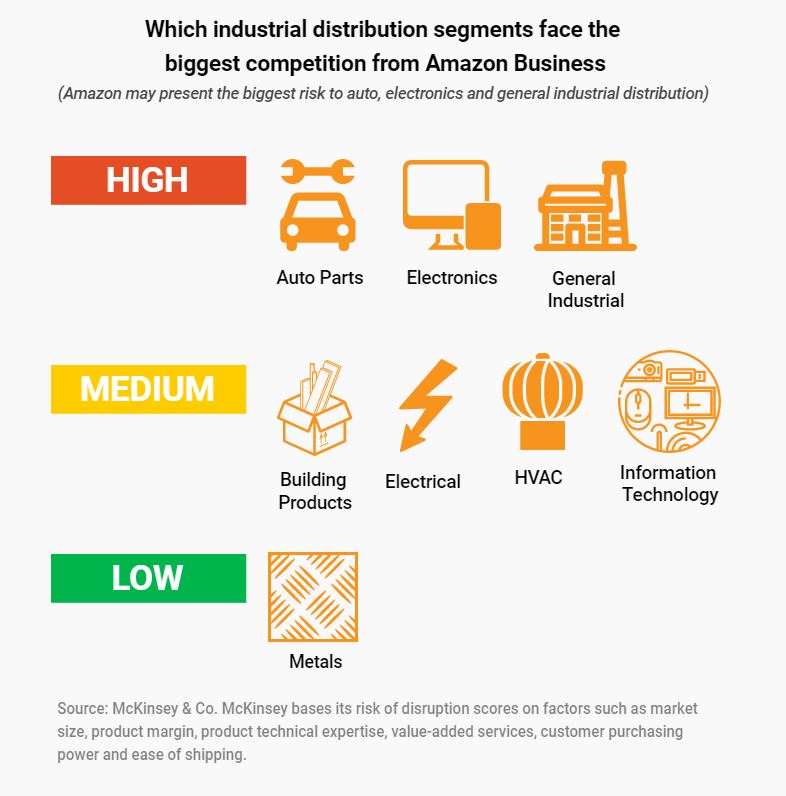

A study by McKinsey & Co., neatly summarized in this B2Bec News infographic, attaches empirical evidence to a reality that many B2B company leaders already know firsthand. That is, the undeniable fact that industrial distributors must have an effective eCommerce channel in 2019 to keep pace with Amazon Business and other digital disruptors.

Auto parts, electronics and general industrial (MRO) distributors are in the most danger, according to the research. These companies trade in products that can be easily boxed up and shipped out to end customers, which translates to a layup for Amazon. As MDM’s Ian Heller said at our MindShare event in May, “Amazon has out-Graingered Grainger.”

If purchasing goods from your company requires little technical expertise or value-added services, or if your products carry hefty margins, you need to be selling online … yesterday. Amazon has pioneered and dominated the complete order-to-delivery process online, and they’re out to grab as much market share as possible. As their leader often says, “Your margin is my opportunity.”

Knowing Amazon’s stance, it’s essential for distributors to establish an alternative method to selling to customers online. This is important, not only from a market share standpoint, but also to avoid handing over highly valuable end customer data and product catalog information. If your margin is their opportunity, imagine the opportunity your data could provide.

The next category down, medium risk, is comprised of industry segments where sales cycles tend to be highly technical or require large, complex shipments. Industries such as building products and electrical products distribution are a bit more insulated from the threat, but by no means immune. In fact, according to McKinsey, “experts we have interviewed mentioned that digital disruptors like Amazon are now partnering with third-party vendors to ship large, bulky products, such as refrigerators and lumber.”

It was only a matter of time.

Even if difficult-to-ship products have been a barrier, Amazon has proven getting creative with third parties is possible. In addition to the functionality and delivery of an eCommerce site, it’s critical to deploy relevant customer-specific pricing and product guidance at the point of sale. By doing so, your efforts to fully support customers - and increase average order value - are far more likely to be successful.

Turning a Threat into an Opportunity

But enough with the doom and gloom. There’s money to be made online, namely because the consumer norm of preferring to buy online is steadily creeping into B2B. In short, your customers increasingly want to purchase online and they expect you to serve them there, or they’ll go elsewhere.

On top of that, more and more manufacturers are choosing to partner with Amazon to get their products out to market. Think about why manufacturers are making the decision to sell through Amazon. It’s a calculation, wherein they may sacrifice margin and/or customer information, but in exchange gain a wider reach and the ease of doing business through a trusted online channel.

While on the surface that’s a scary proposition, innovative distributors see an opportunity to enhance their own value proposition through eCommerce. By leveraging their inherent advantages over Amazon, like hard-earned relationships and value-added services, these distributors are solidifying customer and supplier relationships by making the buying experience more efficient. They also use their online presence to enter new markets quickly.

According to John Gunderson of Modern Distribution Management, “Amazon has been a threat, but it’s driven a lot of investment [in digital sales] and a lot of hard thinking in terms of strategy, as well. Amazon is just one part of something that’s much larger in terms of the whole digital transformation journey and how customers are buying and how distributors are shifting their sales models to meet that.”

For high turn, replenishable businesses like auto parts, electronics and general industrial distributors, standing up an eCommerce channel requires that existing customers are served up prices that make sense as well as suggestions to add complementary products at checkout. By doing so, you can increase average order size as well as provide the suggestive selling B2B buyers are used to as consumers.

Pricing is Still the Brass Tacks

For any distribution vertical industry, the shift to eCommerce must include an air-tight pricing strategy. The McKinsey study revealed that “customers turn to digital players mainly for price and convenience.” Customers have more buying and negotiating power thanks to the visibility afforded by eCommerce. If new online buyers don’t like your prices, they’re not going to tell you – they will just go elsewhere. More importantly, your existing customers expect to purchase at their negotiated price, not the list price new customers see, when buying online. Solving for that in B2B can get tricky.

It’s difficult enough to consistently deliver rational pricing offline, when cost inputs are constantly changing and the “right price” can vary from purchase to purchase, even for the same customer. When pricing doesn’t match customer expectations, a host of margin leakage issues can take place.

Succeeding in B2B eCommerce requires a focus not only on the technology and the delivery, but ensuring you serve up customer-specific guidance for every transaction that happens on the new digital channel. In addition to having a functioning eCommerce platform that allows customers to order online, to be successful online it’s critical to infuse that channel with pricing and product guidance that ensures the Amazon-like experience customers increasingly demand.

For more information,speak with one of our in-house experts.